Ideal Info About How To Appeal Irs

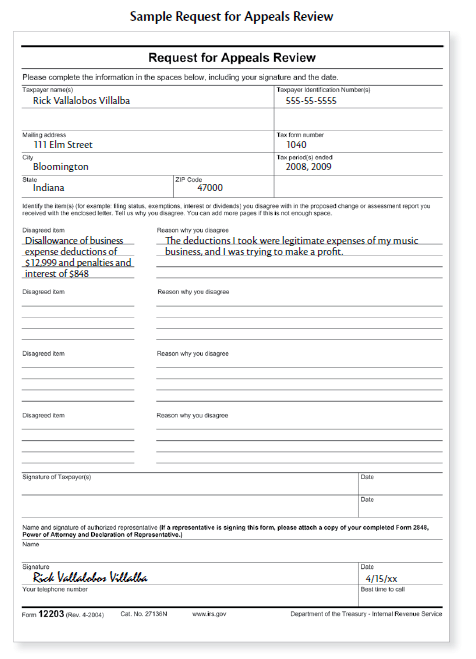

You must submit form 12153 to the irs to request an appeal;

How to appeal irs. The notice of deficiency tells you the tax irs assesses plus the interest and. It’s important to note that the appeals office in your area is. We work with you and the irs to resolve issues.

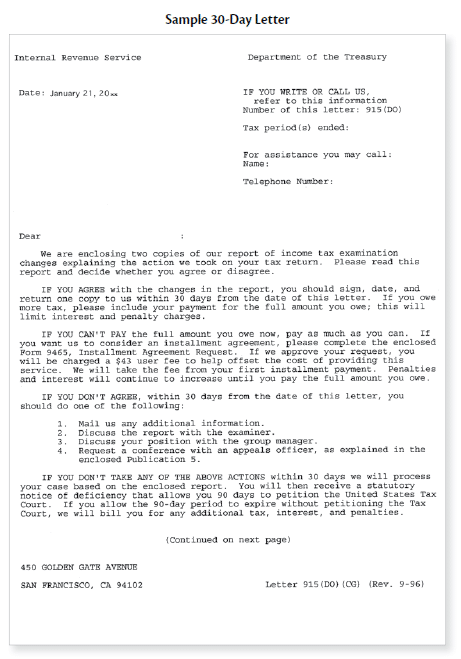

You can file an appeal within 30 days of receiving notification that the irs will garnish your wages; Ad the irs contacting you can be stressful. If both parties agree, the irs appeals officer will issue a form 870 or the consent to proposed tax adjustment.

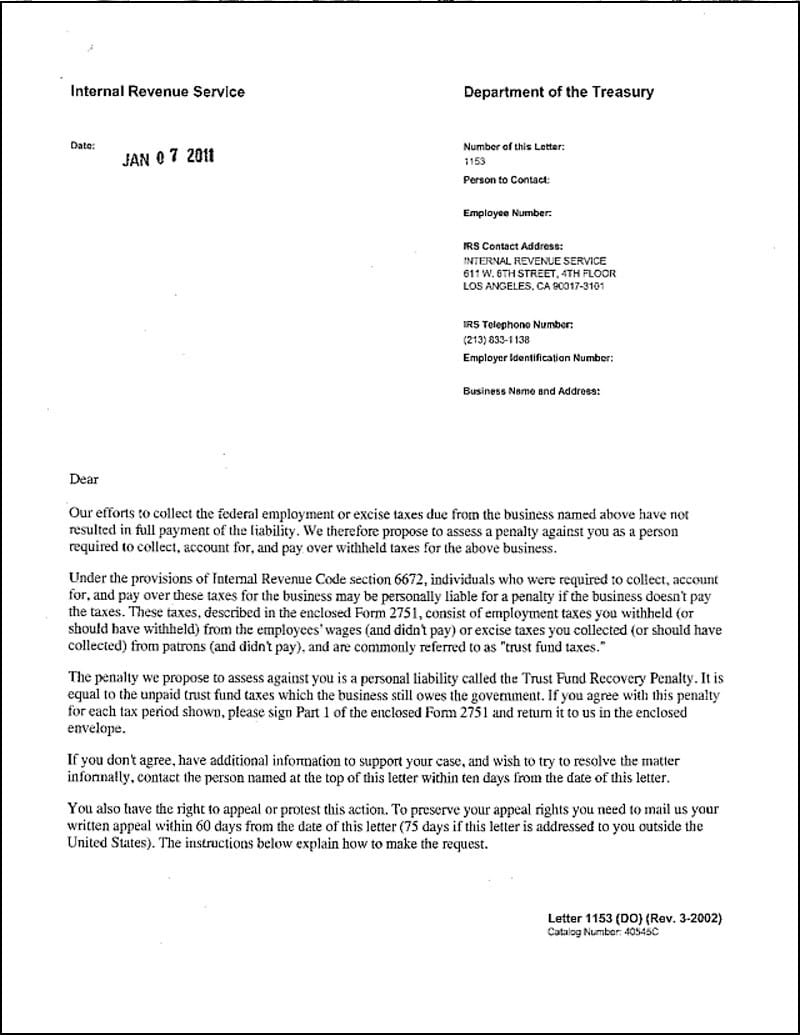

Appeals can’t assist with resolving your tax matters until your request for an appeal has been processed by the irs office working your case. Taxpayers have the right to a fair administrative appeal of most irs decisions. We can help with wage garnishments, liens, levies, and more.

This office is separate from. Ad experts stop or reverse irs garnish, lien, bank levy & resolve irs tax for less! If the irs rejected your request to remove a penalty, you may be able to request an appeals conference or hearing.

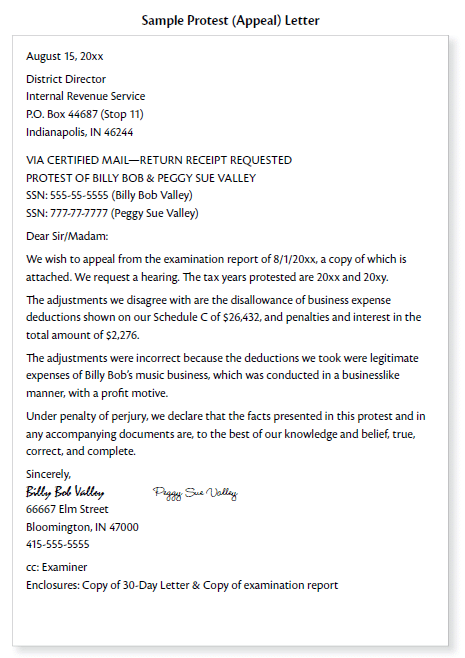

You received a letter from the irs explaining your right to appeal the irs’s decision. A formal protest is a letter sent to the irs if your irs tax audit is more than $25,000. How to file a small case request.

You can go back to irs appeals after responding to a notice of deficiency: You do not agree with the irs’s. If you’re a tax lien or have a dispute irs tax debt, consider seeking advocacy to understand your rights.